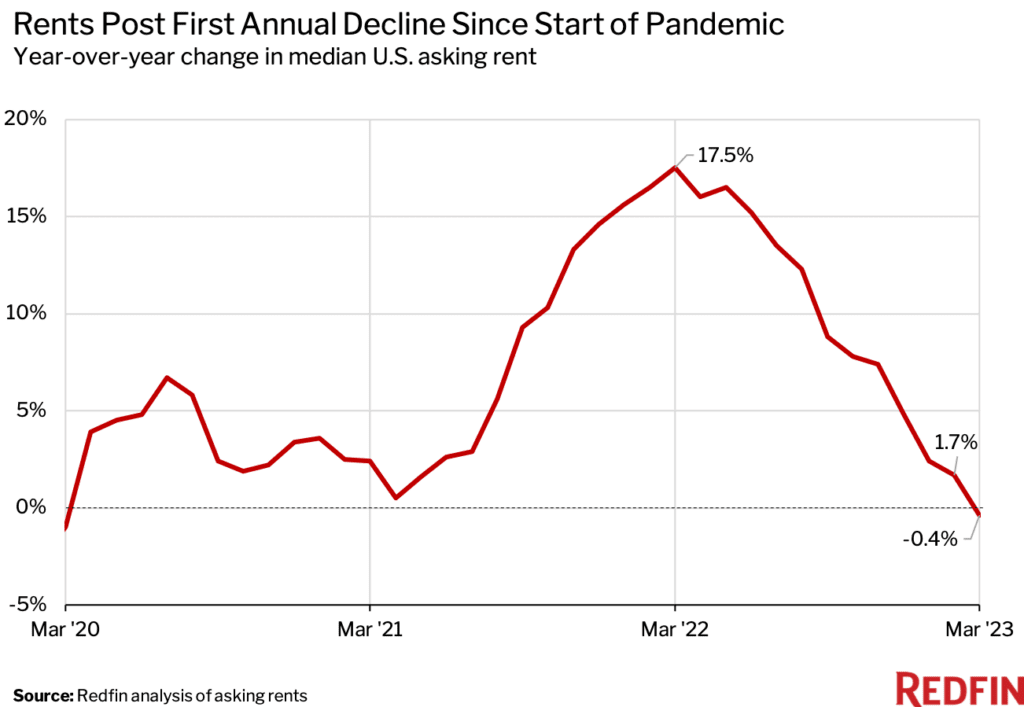

Rental Market Tracker: U.S. Rents Post First Annual Decline in Three Years

Author: Joseph Gozlan, Eureka Business Group | Published: 04/18/2023

I came across this article by Redfin: https://www.redfin.com/news/redfin-rental-report-march-2023/?utm_source=newsletter.credaily.com&utm_medium=newsletter&utm_campaign=rent-prices-drop-yoy-for-the-first-time-since-2020 and felt that this needs to be said…

In a world where sensational headlines dominate the news cycle, it’s easy to get caught up in the hype. But when it comes to investing in the multifamily real estate market, it’s important to take a step back and read through the noise.

The past few years have been turbulent for the multifamily market, with rising rents and a shortage of affordable housing driving demand for rental properties. However, the tail end of COVID-19 pandemic and the rampant inflationary conditions have introduced a new set of challenges, with some markets experiencing sharp declines in rent growth while others continue to grow steadily.

Despite these challenges, multifamily remains a strong asset class and is often one of the first to recover from recessions. But as investors consider their options for 2023, it’s important to take a closer look at the factors impacting the market and make informed decisions based on a comprehensive understanding of the landscape.

The State of the Market

According to recent data, rents are still overall very high in most markets, despite some areas experiencing a decline in growth. For example, Austin, TX has seen a significant 11% drop in rent growth, while other markets remain relatively flat or experience minimal growth in the 1%-2% range.

It’s important to note that rent growth is only one side of the equation when it comes to assessing the health of the multifamily market. Investors must also consider the impact of rising expenses on the net operating income (NOI) of their properties.

Challenges and Opportunities

One of the biggest challenges facing multifamily investors in 2023 is the increasing cost of labor and materials. The COVID-19 pandemic has led to a shortage of workers in many industries, including construction, which has driven up wages and made it more difficult to complete projects on time and on budget.

Additionally, the cost of materials has also risen sharply, with shortages of lumber, steel, and other essential building supplies leading to supply chain disruptions and price spikes. These factors have contributed to a significant increase in expenses for multifamily properties, which can erode the NOI and make it more difficult to achieve desired returns.

However, despite these challenges, there are also opportunities for savvy investors who are willing to think creatively and adapt to changing market conditions. For example, some investors may be able to take advantage of the current climate to acquire distressed properties at a discount and add value through strategic renovations and improvements.

Others may be able to leverage technology to streamline operations and reduce costs, such as by implementing smart home features that allow for remote monitoring and energy management. By staying up-to-date on emerging trends and taking a proactive approach to asset management, investors can position themselves for long-term success in the multifamily market.

Making Informed Decisions

As with any investment, it’s important to approach the multifamily market with a clear understanding of the risks and rewards involved. While multifamily can be a lucrative asset class, it’s not without its challenges, and investors must be prepared to navigate the ups and downs of the market.

If you’re considering investing in multifamily in 2023, it’s important to do your due diligence and research the local market conditions, including factors such as job growth, population trends, and the supply-demand balance for rental properties. You should also work closely with a trusted advisor who can help you evaluate potential properties and assess their potential for long-term growth and profitability.

Ultimately, the key to success in the multifamily market is to take a measured approach and avoid getting caught up in the hype of sensational headlines. While it’s tempting to react to short-term fluctuations in rent growth or other market indicators, it’s important to keep your eye on the long-term trends and make informed decisions based on a comprehensive understanding of the market dynamics.

This requires a willingness to read through the noise and stay focused on the fundamentals of real estate investing, such as cash flow, NOI, and long-term growth potential. By taking a disciplined approach and working with experienced advisors and partners, investors can position themselves for success in the multifamily market in 2023 and beyond.

In conclusion, the multifamily market is facing a range of challenges and opportunities in 2023, from rising expenses to changing market conditions and emerging technologies. However, with the right approach and a willingness to adapt to changing circumstances, investors can position themselves for long-term success in this dynamic and ever-changing asset class. Whether you’re looking to buy, sell, or hold multifamily properties in the coming year, feel free to reach out to us so we can help you achieve your goals!

Joseph Gozlan,

Commercial Real Estate Advisor

- Email: Joseph@EBGTexas.com

- Office: (903) 600-0616

- Mobile: (469) 443-6336